The potential benefits of claiming the R&D Tax Credit are significant, with many manufacturers saving hundreds of thousands of ... Read More

If the chaos of 2020 showed us one thing, it’s that businesses need to be ready because things can change quickly. And while CFOs throughout ... Read More

A trusted CPA is a valuable resource for any business. From tax preparation and auditing to consulting and financial planning, the right CPA lends ... Read More

The Make It Right podcast by Janet Eastman recently featured John Madsen, Vice President and Manufacturing Practice Leader at Black Line ... Read More

Congratulations! You’ve discovered that your business qualifies, and you’re going to claim, the R&D Tax Credit. Now, you need to determine who ... Read More

If you’re considering reducing your tax liability by claiming the Research and Development (R&D) Tax Credit for your business, you may have ... Read More

Congratulations! You’ve decided to consider the benefits of the Research and Development (R&D) Tax Credit for your business.

R&D ...

Read More

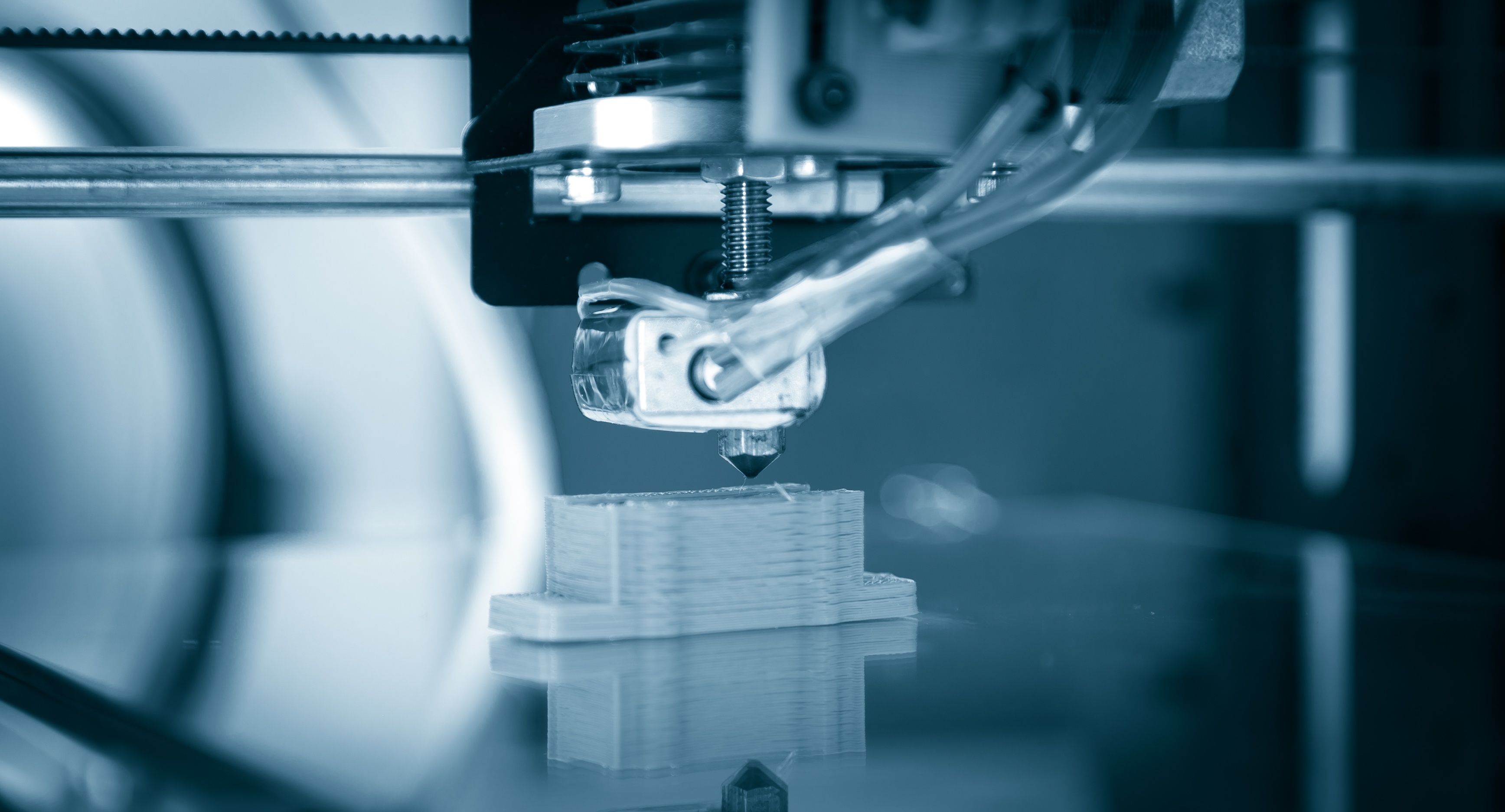

Manufacturing custom parts and/or products takes time, energy, investment, and a whole lot of steps to get from ideation to finished product. ... Read More

Do you think the R&D Tax Credit is only available to large high-tech, pharmaceutical, or research & development-centric companies? Never ... Read More

It’s a common misconception that the R&D tax credit only applies to activities performed by employees in a clean room wearing white lab coats. ... Read More