Congratulations! Your quote was accepted and you were awarded the job. Now, the manufacturing process begins.

Congratulations! Your quote was accepted and you were awarded the job. Now, the manufacturing process begins.

For metal fabrication projects that require flat blank layouts, your team must complete a number of tasks including programming and figuring out how to utilize raw materials in the most cost-effective way possible. While order fulfillment is the ultimate goal, the steps you take from design to finished product could yield more than just a satisfied customer. Here's how your manufacturing processes could also qualify for valuable R&D tax credits.

From Layout to Finished Product

Once the paperwork is completed and the shop traveler (design and manufacturing process documentation) is assembled, the next step is programming. Every stamping or sheet metal fabrication project starts with the flat sheet stock. To determine the material requirements, start with the flat blank. The flat blank size is the footprint of the part as it is unfolded and laid flat on the sheet stock.

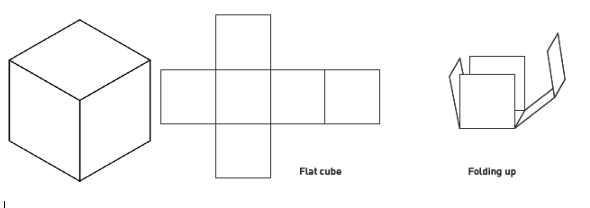

Take, for instance, a six-sided cube with 2" square sides. When you “unfold it” or lay it flat, the material is shaped like a cross, occupying an 8"x6" piece of sheet stock. This flat blank will now need to be punched or laser cut from a sheet of material.

What is the most efficient way to use the material? What is the best way to nest the flat blanks to reduce material cost? How large of a web is needed (how close can each part be to the next part) to support the part through the laser or punching operation? The answer to all of these questions depends on the flat blank and the programmer or engineer evaluating the alternatives.

But when it comes to potential tax credits, the solution isn't nearly as important as the process. That's because all of the programming activities involved in evaluating alternatives and experimenting with materials are qualifying R&D activities.

Whose Activities Qualify as R&D?

If your manufacturing process sounds similar to the one described above, you're probably within reach of those R&D tax credits. But with so many team members involved throughout the design, quoting, and fabrication phases of the process, it can be hard to know whose work actually qualifies.

As a general rule, any individuals participating in programming and material evaluation activities qualify for the R&D credit. Immediate supervisors and managers may also be included depending on your workflow structure and internal processes. In other words, if an employee's intent is to develop or improve a product for performance, cost reduction, or quality improvements due to a customer’s rejection or reliability requirements, their activities likely qualify for R&D tax credits.

Just as flat blank layouts don't look like much until they're assembled, your internal processes might not seem valuable in and of themselves. But in utilizing them the right way, they become greater than the sum of their parts. By tracking your programming process and the ways in which you utilize flat blank layouts, you could be in line for valuable tax credits you can use to improve your business as a whole.